Your Family Budget is part of the Saving 201 series that looks at financial life after coupons – because it can’t all be about coupons.

I’ve said that coupons changed my financial outlook on life, that Dave Ramsey changed the way I looked at budgets, but none of those compare to the financial revolution I experienced when I started using this….

Are you ready?

Still ready?

….the spiral bound notebook.

I know, high tech, right?

Here’s the deal….Hubs and I tried the “plot-all-your-monthly-expenses-into-a-spreadsheet” thing.

We tracked our yearly spending for things like car repairs, car insurance, and home repairs. We totaled them up and divided by twelve and came up with some goofy number like $63.42. And, ideally, we should have put that number “aside in a savings account” every month.

However, more times than not, we never put the money aside. Since there wasn’t a real expenditure, we found other ways to spend the money.

Or if we did put it aside, it seemed inevitable that the brakes would go out on a car. And we would have to put the bill on the credit card anyway, because we only had $160 in an account for a $420 job.

So the year-end-break-it-down-by-twelve-months-budget was a BUST for us. (Maybe some of you can relate?)

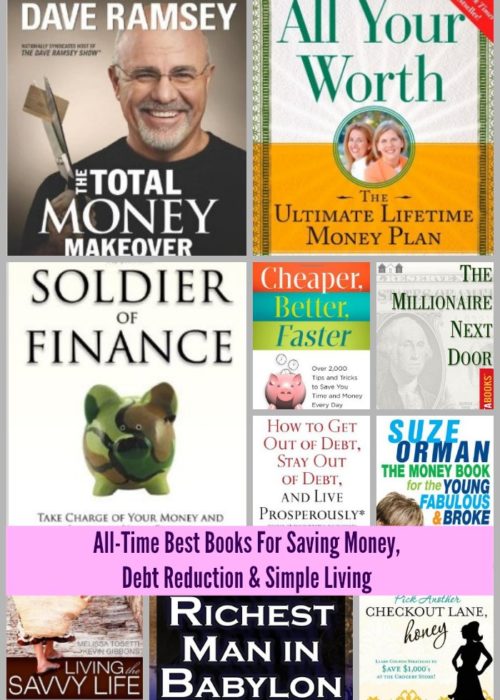

It wasn’t until reading Dave Ramsey’s Total Money Makeover and his idea of throwing out the twelve-month budget and replacing it with a monthly budget, that the lightbulb went on for me. Instead of living within a semi-fictious budget, the monthly budget would force us to make decisions where the rubber met the road, at the time that they happen.

Here is a how a family budget for a month works.

Step #1: In a monthly budget, you write down your income for the month. Let’s say that is $4000. (In our house, we do it in a spiral bound notebook.)

Step #2: Then you write down all your regular expenses for the month (these are recurring expenses). In our house, this includes: Mortgage, Health Insurance, Disability Insurance, Retirement Savings, Utilities, Tithe and Charitable Giving, ESA Savings, DD Preschool Tuition, Savings, Gas, Groceries, Wine/Beer Budget, Family Fun, Childcare, Clothes, Haircuts, Vacation Savings Account and Christmas Savings Account. (You pull all of these numbers from your Long Term Financial Picture.)

Step #3: Now, add in any extra expenses for the month (these are non-recurring.) In our house, this can include Dental Bills, Car Insurance, Car Repairs, Home Repairs, Dr. Visits, Kid’s Activities, etc.

Step #4: Now add up those numbers. If your expenses are below your monthly income, great. If not, you’ll need to start cutting line items or decrease the amount in an line item to make your budget/income equal out and meet your long-term financial goals.

Remember, the goal is to not “tap” into savings or a credit card to meet your monthly expenditures.

Is this a HARD exercise? Absolutely.

I remember the first month Hubs and I did this. It was an expensive month. Not only did we have our regular expenses, we also had unexpected car repairs.

When we did our monthly budget, we realized that our expenses were going to be a lot more than our income. If we were going to stay true to our plan, we would need to cut. And so we cut – and then we had to cut even more.

It was hard. I’ll be honest, I was sad. I had visions of living like a Monk with a vow of poverty so that I could reach some far-out-there financial goals. It didn’t feel good at the time.

But you know what, we made it through the month. (Without any trips to Starbucks.)

Then it was time for month two and three. There weren’t as many expenditures, so we had wiggle room to do some fun things. Plus, we had piece of mind, because we knew the money was there.

Even now, two years later, there are months that are tighter than others. But going through those tight months made us aware of how many “extras” we have in our budget. We learned that life would not stop if we didn’t have “extras”.

It also gave us a better perspective of what is truly important in life. And it is amazing how much we take for granted.

Homework

1. Make the decision to do a monthly budget in February. Start gathering your facts.

2. Make an appointment with your significant other and go over your long-term financial goals, as well as your monthly budget.

3. Make an agreement TOGETHER to stick to the budget.

You did a great job explaining this. It was also a huge thing for us when we grasped the new-budget-every-month concept.

Now that we’ve been doing this for several years, other things like the car-repair fund, home repair fund, etc. are starting to make sense as well. After funding our emergency fund, we started separate accounts for those things, and now that they’ve had some time to build up, it’s incredibly exciting to be able to pull from the home fund when a repair comes up. And we just scheduled our summer vacation to Disney World, which wouldn’t be possible if it weren’t for purposeful vacation savings!

Thanks Nony. And you are right. Once you’ve had the chance to fund something completely and pay for it ahead of time – you’ll never go back to the old way.

I love the notebook idea – sometimes I spend so much time trying to make the perfect system or spreadsheet and then do not even use it! Keeping it simple will allow me to actually take the time to analyze the spend versus making it look pretty.

Great post. I have a question. Are you making the budget at the beginning of the month? If so, how do you know how much to put for things like car repairs that come up during the month? Or do you just adjust it throughout the month? Look at the bills you have at the time and estimate? My husband and I have been trying (half-heartedly, I admit) to do a budget but we’re not any good at it yet. I appreciate your posts on the subject. It has got me thinking about it again.

Great question. If we have an unexpected car repair that comes up we either (a) adjust the current budget and pay for it right away or (b) adjust the current budget as much as possible and adjust the next months budget to pay for the bill. (Most places allow you 30 days if you pay some up front.)

We never estimate. We pay every bill based on what it is every month. We can do that NOW because we have a $1000 emergency fund that is separate from our savings. So when the car repairs come up – we pull from there and then work on restocking it the next month. Hope that helps.

That makes a lot of sense. We have an emergency fund, but it is just lumped in the same account with our other savings. It sounds like it might be a good idea to put it in its own account. Thinking about it from the perspective of using that fund, if needed, and then restocking it the next month makes a lot of sense. Thanks!

I so need to do this, but I need buy in from someone I love first. Any suggestions on that?

Thanks for showing me step by step how you do it!

We live by a very detailed yearly budget. We sat down and created it in November/December after reviewing our yearly expenses for 2010. We use excel though. However, I do like writing things down 🙂

My inner rebel still bucks up against the idea of concrete budget. Oh, Kelly, why did you have to bring this up? I may have to crack open the Dave Ramsey books that I bought a while back. The ones that I bought because I’m a frugal blogger and SHOULD know a little more about it.

Still trying to find the balance between Dave Ramsey and Shane Claiborne (Irresistible Revolution). I’ll let you know when I figure it out 🙂