Your Family Budget is part of the Saving 201 series that looks at financial life after coupons – because it can’t all be about coupons.

Last week I talked about how my family made long-term financial goals.

This week I’ll talk about how I almost got a divorce. (Not really.)

After Hubs and I made our long-term financial goals, the next step was to take a look at our previous spending and get an idea of where our money was going.

We plugged in the essentials – mortgage, utilities (gas, electric, water, phone, cable, internet), insurance, child care and preschool, groceries, wine and beer, tithe, etc. We looked at the numbers and realized there was about a thousand dollars difference in what we were spending on paper vs. what we were really spending. And we both thought….

Where is all this money going?

And then the “name-blame-game” started.

“Well, you go out with the boys for beers – that’s like $50.”

“Well, you sure enjoy those pedicures – aren’t those like $50 for someone to rub on your feet.”

“Well, we seem to spend a lot of money on gardening stuff. Do we need ALL that?”

“Well, you seem to like to shop at Nordstrom’s – do you NEED that?”

You get idea. It was an all-out assault on each other to figure out where that $1000 went. And in our minds, we were each the innocent party. And so we yelled, argued, and stomped around. And looking back, the reason for the yelling – we were both embarrassed that we didn’t have a better idea of where our money was going.

So before you and your significant other start figuring out where your money has gone month-after-month – take a moment and agree that you will not play the “name-blame-game” with each other. (And avoid having someone sleep on in the spare bedroom for awhile.) Remember…

You can not change where your money went in the past, you can only change what you do with it in the future.

Homework

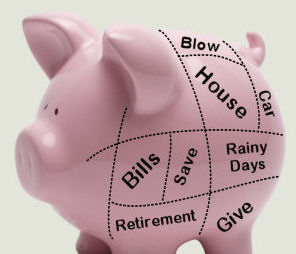

Put together a financial picture of where your money has gone month-after-month. The goal is not to put together a budget, but to get an concrete idea of where your money is going, so you can create a budget next week.

There are many ways to create a financial picture.

- You can track your expenses by category in an excel spreadsheet.

- You can set up online tracking (with automatic feeds from your credit/debit card) with Mint.com. (Which we use – it has pretty graphs.)

- If online worries you, you can purchase Quicken Software and manage it from your computer.

Category ideas for your financial picture.

Housing

- Mortgage or Rent

- Utilities

- Maintenance

Debt Payments

- Credit Cards

- School Loans

- Car Payments

Family

- Child Care

- Insurance

- Prescriptions or OOP health costs

- Baby-sitting

- Education

Investments

- IRAs or 401Ks

- ESAs

- Savings

- Other investments

Miscellaneous

- Groceries

- Eating Out

- Clothes

- Entertainment

- Vacations

- Gifts

- Tithe

- Gas

- Car Repairs

Remember, you can’t change where your money went in the past. You can only effective change in the future. And without taking an honest look at your money, you won’t be able to meet your goals.

(Join me next Tuesday as we talk about creating a monthly budget. Also remember to check out these fellow bloggers posts on ways you can Renew for You in 2011.)

Organizing Your Shopping Trips – from My Coupon Teacher

Self Esteem – Stripped Naked – from Maven of Savin

Frugal Weight Loss – from Stockpiling Moms

Care for Yourself: Perfectionism To Grace – From Give Me Neither