Your Family Budget is part of the Saving 201 series that looks at financial life after coupons – because it can’t all be about coupons.

I’ve said that coupons changed my financial outlook on life, that Dave Ramsey changed the way I looked at budgets, but none of those compare to the financial revolution I experienced when I started using this….

Are you ready?

Still ready?

….the spiral bound notebook.

I know, high tech, right?

Here’s the deal….Hubs and I tried the “plot-all-your-monthly-expenses-into-a-spreadsheet” thing.

We tracked our yearly spending for things like car repairs, car insurance, and home repairs. We totaled them up and divided by twelve and came up with some goofy number like $63.42. And, ideally, we should have put that number “aside in a savings account” every month.

However, more times than not, we never put the money aside. Since there wasn’t a real expenditure, we found other ways to spend the money.

Or if we did put it aside, it seemed inevitable that the brakes would go out on a car. And we would have to put the bill on the credit card anyway, because we only had $160 in an account for a $420 job.

So the year-end-break-it-down-by-twelve-months-budget was a BUST for us. (Maybe some of you can relate?)

It wasn’t until reading Dave Ramsey’s Total Money Makeover and his idea of throwing out the twelve-month budget and replacing it with a monthly budget, that the lightbulb went on for me. Instead of living within a semi-fictious budget, the monthly budget would force us to make decisions where the rubber met the road, at the time that they happen.

Here is a how a family budget for a month works.

Step #1: In a monthly budget, you write down your income for the month. Let’s say that is $4000. (In our house, we do it in a spiral bound notebook.)

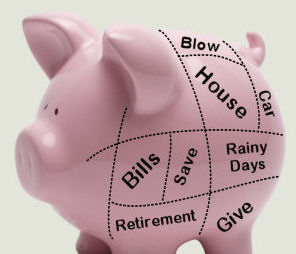

Step #2: Then you write down all your regular expenses for the month (these are recurring expenses). In our house, this includes: Mortgage, Health Insurance, Disability Insurance, Retirement Savings, Utilities, Tithe and Charitable Giving, ESA Savings, DD Preschool Tuition, Savings, Gas, Groceries, Wine/Beer Budget, Family Fun, Childcare, Clothes, Haircuts, Vacation Savings Account and Christmas Savings Account. (You pull all of these numbers from your Long Term Financial Picture.)

Step #3: Now, add in any extra expenses for the month (these are non-recurring.) In our house, this can include Dental Bills, Car Insurance, Car Repairs, Home Repairs, Dr. Visits, Kid’s Activities, etc.

Step #4: Now add up those numbers. If your expenses are below your monthly income, great. If not, you’ll need to start cutting line items or decrease the amount in an line item to make your budget/income equal out and meet your long-term financial goals.

Remember, the goal is to not “tap” into savings or a credit card to meet your monthly expenditures.

Is this a HARD exercise? Absolutely.

I remember the first month Hubs and I did this. It was an expensive month. Not only did we have our regular expenses, we also had unexpected car repairs.

When we did our monthly budget, we realized that our expenses were going to be a lot more than our income. If we were going to stay true to our plan, we would need to cut. And so we cut – and then we had to cut even more.

It was hard. I’ll be honest, I was sad. I had visions of living like a Monk with a vow of poverty so that I could reach some far-out-there financial goals. It didn’t feel good at the time.

But you know what, we made it through the month. (Without any trips to Starbucks.)

Then it was time for month two and three. There weren’t as many expenditures, so we had wiggle room to do some fun things. Plus, we had piece of mind, because we knew the money was there.

Even now, two years later, there are months that are tighter than others. But going through those tight months made us aware of how many “extras” we have in our budget. We learned that life would not stop if we didn’t have “extras”.

It also gave us a better perspective of what is truly important in life. And it is amazing how much we take for granted.

Homework

1. Make the decision to do a monthly budget in February. Start gathering your facts.

2. Make an appointment with your significant other and go over your long-term financial goals, as well as your monthly budget.

3. Make an agreement TOGETHER to stick to the budget.